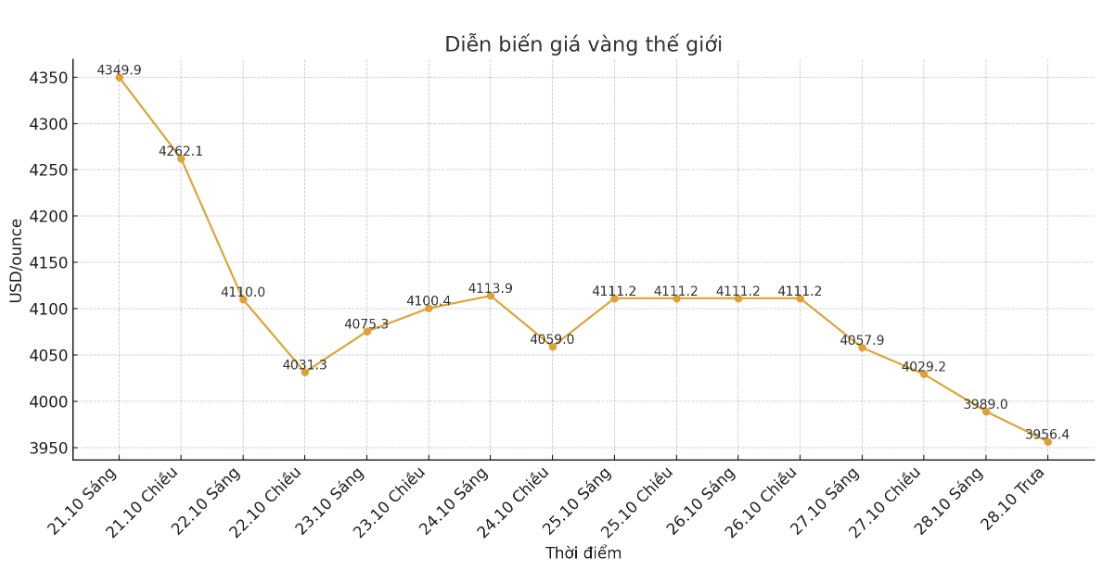

After a strong sell-off last week, the gold market continued to be under technical selling pressure, causing prices to fall below $4,000/ounce. Although the long-term trend is still considered an increase, experts warn that gold prices may fall further in the short term.

Some analysts said that gold is facing a new wave of selling after the US and China reached the framework for trade negotiations, somewhat reducing geopolitical tensions.

In the first session of the week, spot gold largely fluctuated below $4,000/ounce, but at one point recovered slightly to $4,004.5/ounce, down more than 2% on the day. This decrease followed last week's 3% decrease, when the precious metal could not recover after its strongest decline in many years.

Notably, the precious metal continued to record a deep decrease, approaching the threshold of 3,950 USD/ounce.

Fawad Razaqzada - Market Analyst at City Index and FOREX.com - said that selling pressure continues as the S&P 500 sets a new record, trading above 6,858 points.

Golds decline coincides with an optimistic return around US-China trade talks. As risk-off sentiment has increased, the S&P 500 has set a new high, causing demand for safe-haven assets such as gold to decline.

However, analysts are still skeptical that core issues such as national security or technological competition can be completely resolved. However, investors are still pursuing a "risk-off" mentality, reducing the need for precautions against gold," he said.

Razaqzada believes that gold breaking through the $4,000/ounce mark is not too surprising and, based on last week's developments, this decline is inevitable. However, this is still an important psychological threshold.

Selling will be looking for a decisive breakthrough meaning gold prices will remain below this mark for more than a few sessions. If that scenario happens, there is a high possibility of more selling pressure to cut losses from speculative positions. Conversely, if gold stays around $4,000/ounce, this could be an opportunity for bottom buyers to return to the market, he said.

David Morrison - Senior Expert at Trade Nation - commented that the risk of a short-term price decrease still exists as technical momentum is weakening.

The daily MacD index has fallen sharply. While no longer in the overbought zone, it is showing an increased downward momentum, he said, stressing that gold needs to return above $4,100/ounce to restore upward trend.

Meanwhile, Ole Hansen - Head of Commodity Strategy at Saxo Bank - said that gold could enter a new accumulation phase.

After surpassing $3,000/ounce, the market has been flat for four months. According to Hansen, the key support zone is currently at $3,846/ounce, which is the technical pullback of the strong increase in August.

Recent developments show that the high probability of the peak of the year has taken shape. A deeper correction could take the market time to recover amid cautious investors and a strong increase in stocks.

The reasons for gold's price increase have not disappeared, but the question is whether they are qualified to justify the increase of more than 50% since the beginning of the year. In my opinion, the next increase should probably wait until 2026, especially since the recent accumulation period lasted four months, he said.

Chantelle Schieven - Research Director at Capitalight - is monitoring the support zone of 3,750 USD/ounce, corresponding to the 50-day average of gold.

However, she said the long-term outlook for gold remains positive and the current decline is just a technical adjustment, not a sustainable downtrend.

This is a healthy correction period in the long-term growth cycle. We remain bullish on gold, given the macroeconomic risks and current policy, Schieven said.

See more news related to gold prices HERE...