Gold prices fell in the fourth session, under pressure from a stronger US dollar and market expectations of a possible US Federal Reserve (FED) interest rate cut in December, as investors focused on the US employment report being delayed.

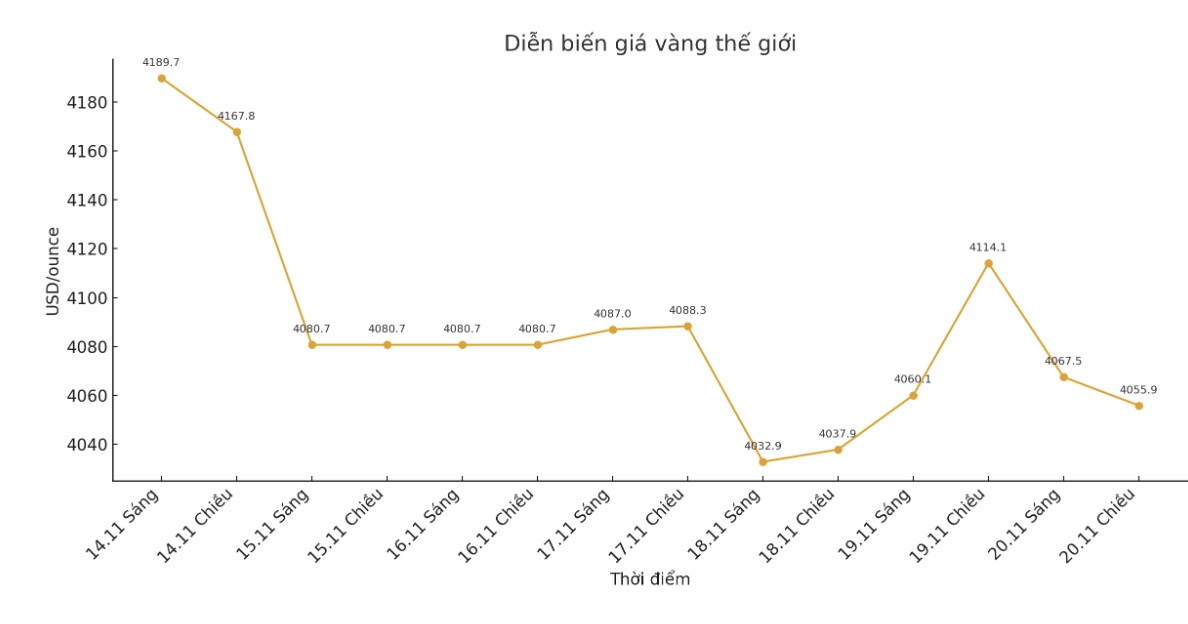

Spot gold prices fell 0.4% to $4,063.81/ounce at 6:53 GMT. US December gold futures fell 0.5% to $4,063.6 an ounce.

Gold prices are currently falling mainly due to expectations of a rate cut that have been significantly narrowed in the past two weeks, said Kelvin Wong, senior market analyst at OANDA.

In the short term, this has caused gold prices to continue to lose weight below the 4,100 USD threshold. I see resistance at $4,155, and gold could trade near $4,000-3,980.

The USD index rose to a two-week high against major currencies, making gold more expensive for holders of other currencies.

Minutes from the Fed's October meeting released on Wednesday showed the central bank has cut interest rates, although policymakers warned that this move could prolong inflation and undermine public confidence in the Fed.

According to CME Group's FedWatch tool, traders now only see a nearly 33% chance of the Fed cutting interest rates at its December 9-10 meeting, down from 49% on Wednesday.

Gold - non-yielding assets often increase in price in low interest rate environments and during periods of economic instability.

The focus is now on the US non-farm payrolls report for September, due to the delay in the government shutdown. This data is expected to provide additional signals about the Fed's policy path.

Economists participating in the Reuters survey predict the report will show an increase of 50,000 new jobs in the month.

SPDR Gold Trust, the world's largest gold ETF, said its holdings rose 0.22% to 1,043.72 tonnes on Wednesday, up from 1,041.43 tonnes on Tuesday.

For other precious metals, spot silver fell 0.6% to $11.07/ounce, platinum moved sideways to $1,546.8, while palladium rose 0.6% to $1,388.58.

Note: The world gold market operates through two main pricing mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries. Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...