Gold prices fell in the trading session on Friday, as the USD strengthened amid concerns about the prospect of the next interest rate cut by the US Federal Reserve (FED). However, the precious metal is still heading for its third consecutive month of increase.

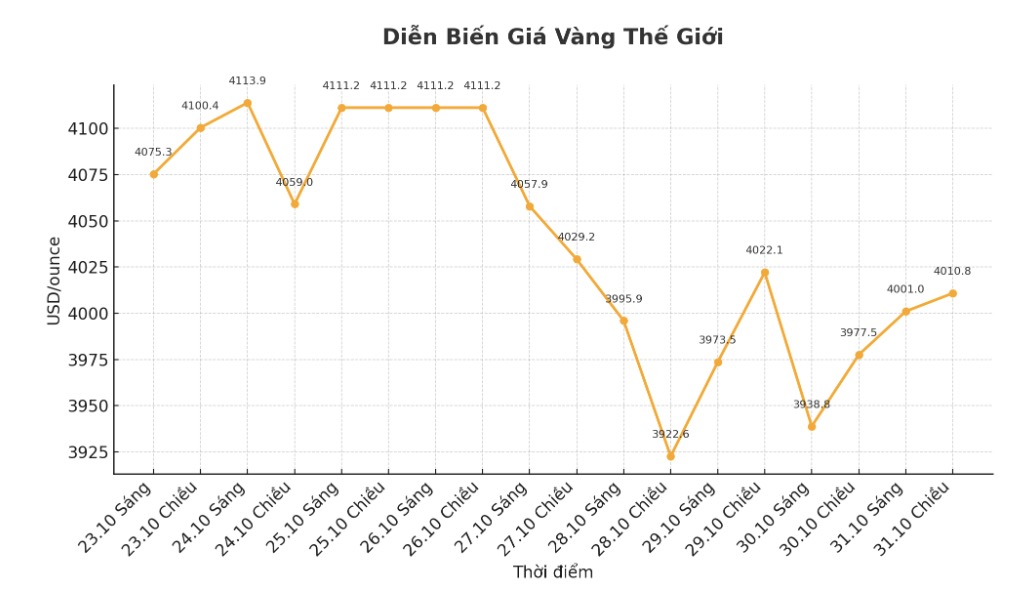

Spot gold fell 0.4%, to $4,005.54/ounce at 04:59 GMT, but has been up 3.9% since the beginning of the month. US gold futures for December delivery are almost flat at $4,018.10/ounce.

Mr. Tim Waterer, Head of Market Analysis at KCM Trade, commented: "The Fed Chairman this week clearly demonstrated the hawkish stance, and that is completely unfavorable for gold prices".

The possibility of the Fed cutting interest rates in December is now much more fragile than previously forecast, which has helped the USD strengthen, while making the outlook for gold more complicated from a yield perspective, he added.

The USD Index continues to anchor near a three-month high against major currencies, making gold more expensive for investors holding other currencies.

On Wednesday, the Fed cut interest rates by another 0.25 percentage points, the second time this year, bringing the operating rate to the target range of 3.75% - 4.00%.

However, investors have reduced expectations that the Fed will continue to cut interest rates at its policy meeting in December, following Chairman Jerome Powell's tough statement.

According to CME Group's FedWatch tool, the market currently rates a 74.8% chance that the US Federal Reserve (Fed) will cut interest rates by another 25 basis points in December, down significantly from 91.1% last week.

In another development, US President Donald Trump said on Thursday that he had reached an agreement with Chinese President Xi Jinping on reducing tariffs on Chinese goods, in return, Beijing would take strong measures to suppress illegal fentanyl trading, resume soybean imports from the US, and maintain stable exports of rare earths to the US.

Meanwhile, in India, gold is being sold at a discount this week - for the first time in seven weeks, due to slowing domestic demand. In contrast, the decline in global gold prices has stimulated more active buying and selling activities in other Asian markets.

See more news related to gold prices HERE...