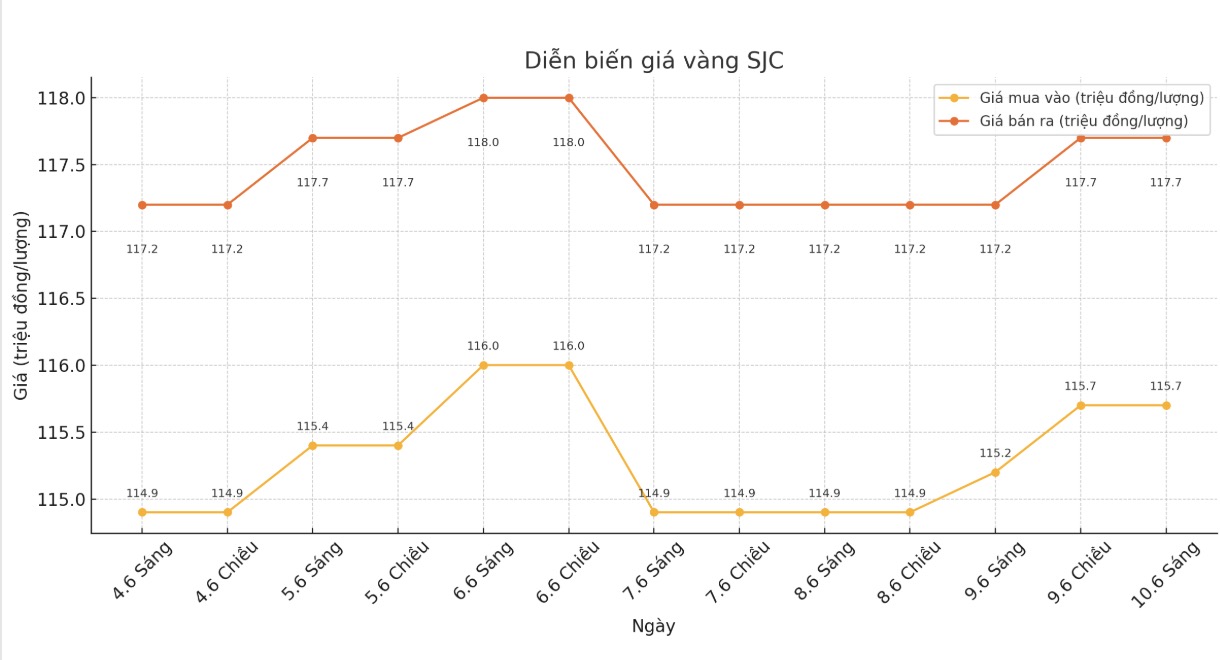

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 115.7/17.7 million/tael (buy in - sell out), an increase of VND 500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 115.7-117.7 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 115.7-117.7 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 115-117.7 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

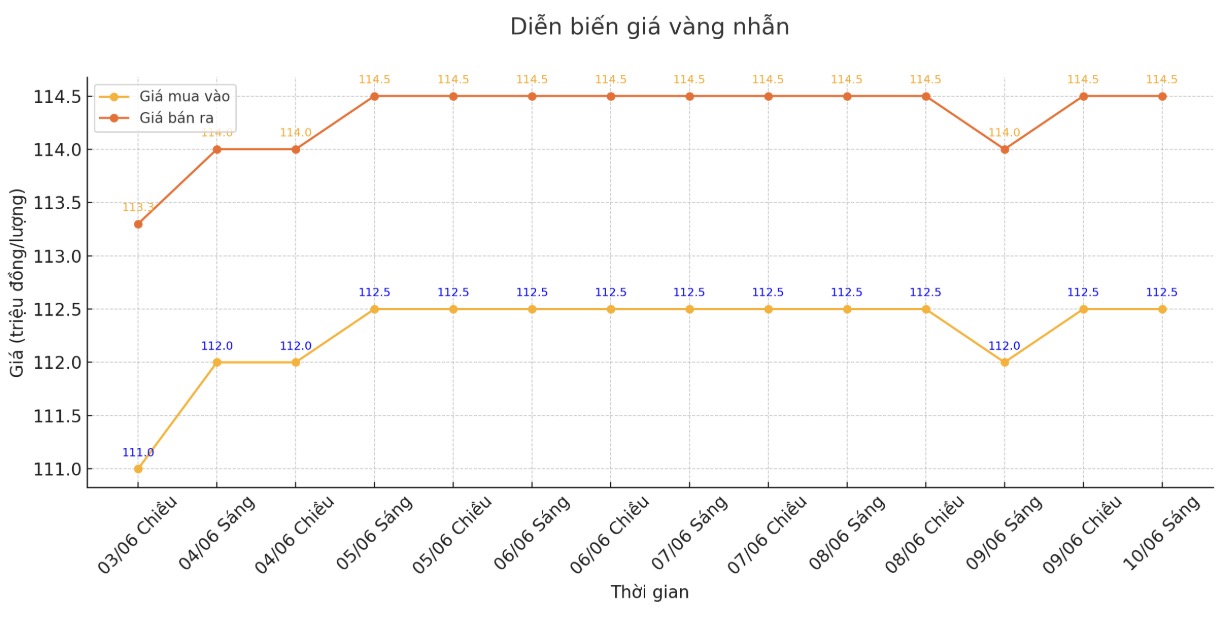

9999 round gold ring price

As of 9:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 112.5-124.5 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113.3-116.3 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111.3-114.3 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

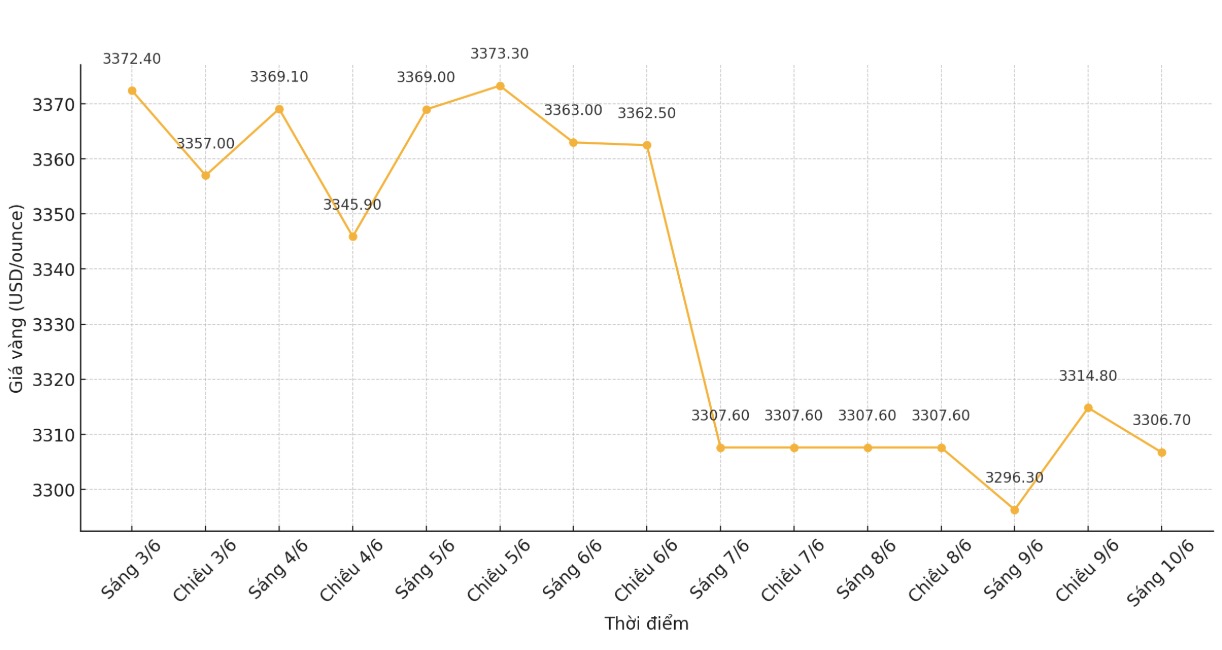

World gold price

At 9:05, the world gold price was listed around 3,306.7 USD/ounce, up 10.4 USD compared to 1 day ago.

Gold price forecast

The world gold market recorded fluctuations when US-China trade negotiations officially began in London (UK), creating a new wave of concerns about trade conflicts.

The recovery of gold reflects investors' more cautious views on the outcome of negotiations. After a period of initial optimism, gold is considered a safe haven as there is no clear sign of progress in US-China relations.

In another development, the People's Bank of China (PBoC) announced on Saturday that it had continued to add gold to foreign exchange reserves in May, marking the seventh consecutive month of buying.

Krishan Gopaul, senior analyst for EMEA at the World Gold Council, wrote: Date released by the Peoples Bank of China shows that their gold reserves increased by nearly 2 tons in May. This raises the total net gold purchases since the beginning of the year to 17 tons, bringing the total gold reserves to 2,296 tons.

China's gold reserves were valued at $241.99 billion at the end of May, down slightly from $243.59 billion at the end of April, according to the PBoC. Gold prices once hit a historic peak of over $3,500/ounce in April, thereby helping to increase the value of the country's gold holdings.

Last year, the PBoC suspended gold purchases for 6 months after a series of 18 consecutive months of increasing reserves. However, the bank has resumed gold purchases since November, following Donald Trump's victory in the US presidential election.

Currently, investors are closely monitoring the US Consumer Price Index (CPI) data. This will be an important basis for assessing the US inflation situation and economic health, and at the same time making predictions about the possibility of the US Federal Reserve (FED) cutting interest rates in the coming time.

Giovanni Staunovo, an analyst at Swiss bank UBS, said investors see gold's momentum, including trade and geopolitical tensions, concerns about debt and weak economic growth, remaining there and will continue to support the precious metal in the coming months.

Economic data to watch this week

Wednesday: US Consumer Price Index (CPI)

Thursday: US producer price index, weekly jobless claims

Friday: University of Michigan Consumer Psychology Index

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...