Updated SJC gold price

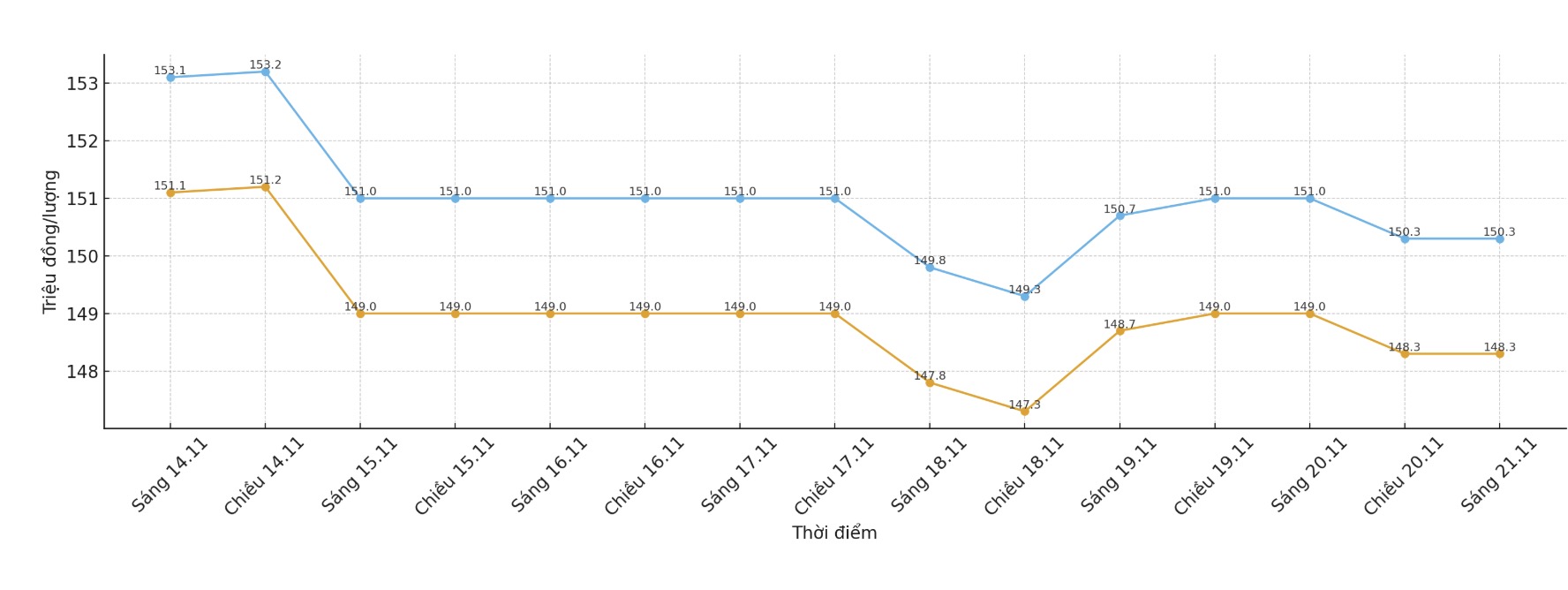

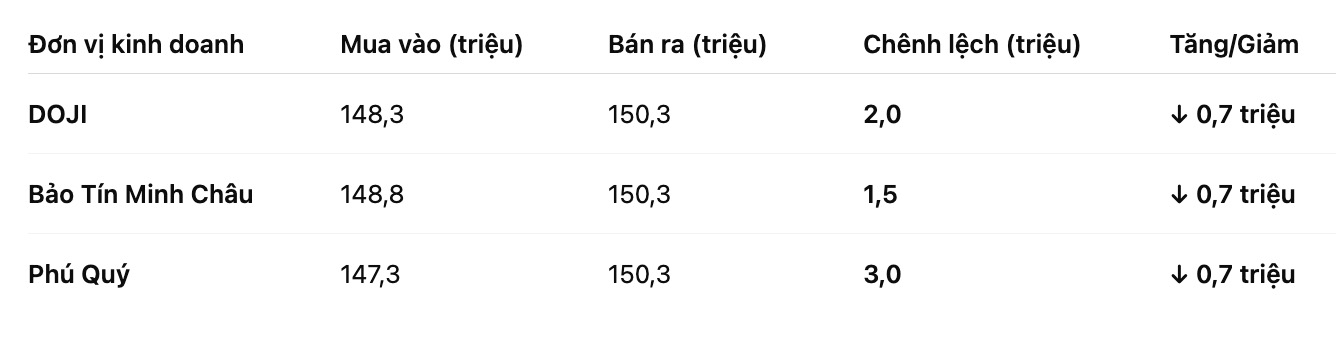

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at 148.3-150.3 million VND/tael (buy in - sell out), down 700,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 148.8-150.3 million VND/tael (buy - sell), down 700,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 147.3-150.3 million VND/tael (buy in - sell out), down 700,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

9999 round gold ring price

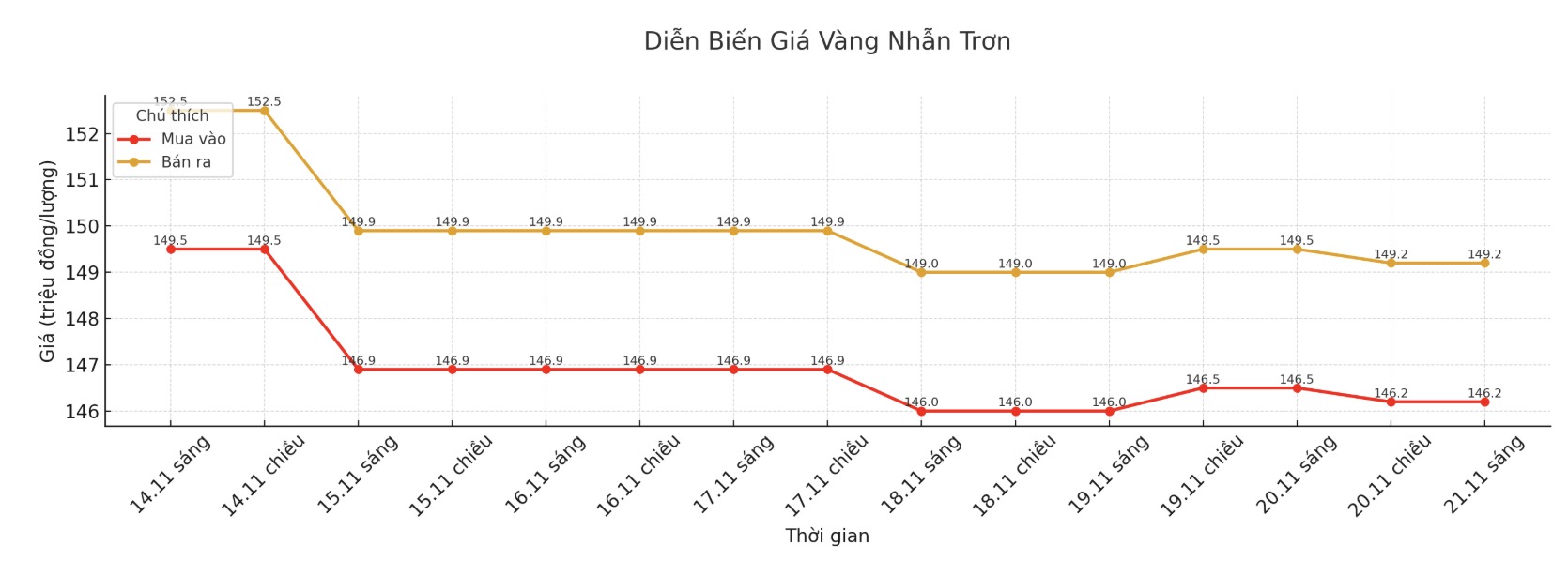

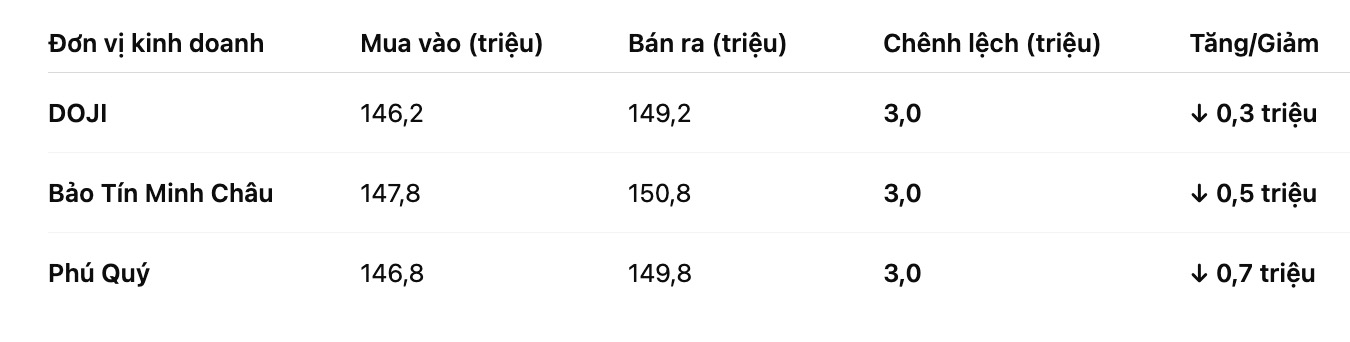

As of 9:00 a.m., DOJI Group listed the price of gold rings at 146.2-149.2 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 147.8-150.8 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 146.8-149.8 million VND/tael (buy in - sell out), down 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

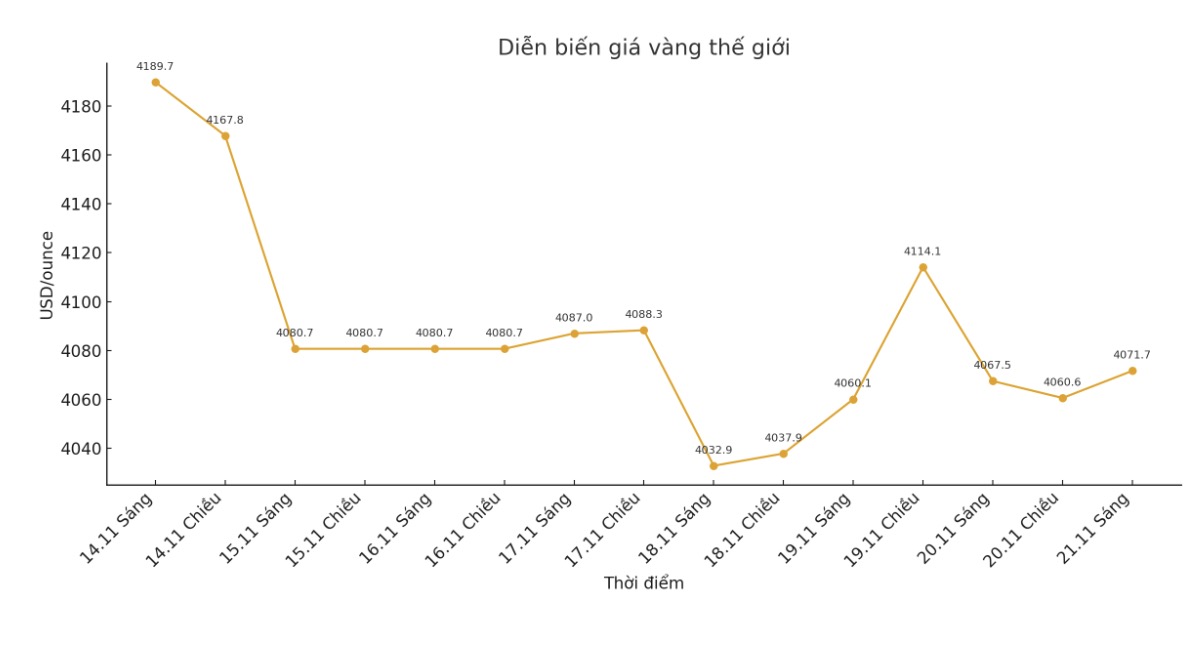

World gold price

At 9:08, the world gold price was listed around 4,071.7 USD/ounce, up 4.2 USD compared to a day ago.

Gold price forecast

Gold prices are struggling as the US economy signals intertwined: The current number of jobs and home sales are all beyond expectations, but the unemployment rate is increasing.

After 43 days of the US Government's closure the longest period in history the US Department of Labor released its September non-farm payrolls report. Accordingly, the economy created 119,000 more jobs, much higher than the forecast of 53,000. Data shows that the labor market still shows a certain level of resilience despite the interruption of data collection and processing time.

However, the report also showed the unemployment rate rose to 4.4%, higher than the forecast to remain at 4.3%. The Ministry of Labor said that the labor market has changed little since April, although the summer data adjustments continue to reflect the slowdown.

In parallel with the labor market report, the National Association of Realtors (NAR) released data showing that the housing market also improved slightly in October. Total existing home sales - including private houses, townhouses, apartments and cooperatives - increased by 1.2%, reaching 4.10 million units/year according to the seasonal adjustment, exceeding the forecast of 4.08 million. Compared to the same period in 2024, sales increased by 1.7%.

In another notable development, UBS (Switzerland's leading financial services group) has just raised its gold price target in mid-2026 to 4,500 USD/ounce - from 4,200 USD before, based on expectations that the US Federal Reserve (FED) will cut interest rates, prolonged geopolitical risks, fiscal concerns and strong demand from central banks and ETF investors.

We expect gold demand to continue to increase in 2026, affected by the Feds forecast of rate cuts, real yield cuts, prolonged geopolitical uncertainties, and changes in the domestic policy environment in the US, UBS wrote in a report on Thursday.

The bank also raised its target price in the scenario of a sharp increase of 200 USD, to 4,900 USD/oz, in case of a political and financial risk outbreak, but still maintained the down scenario at 3,700 USD/ounce.

Technically, the next target for December gold buyers is to get the closing price above strong resistance at a record $4,398/ounce. The nearest target for the sellers is to pull prices below the important technical support zone at $4,000/ounce.

The first resistance level was at an overnight high of $4,109.6 an ounce, followed by a weekly high of $4,134.3 an ounce. First support was at an overnight low of $4,034 an ounce, then as low as $4,000 an ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...